prof-expert-orel.ru

News

Professional Financial Company

Current Disclosure Brochure Professional Financial Strategies, Inc. is an independent investment advisor registered with the Securities and Exchange. financial advisors to guide you on your financial path towards retirement. Offering financial planning and asset management services, PFM meets you where. As an automotive finance lender, we partner with local dealerships in your community to help you secure funds for your next automobile purchase. Professional Financial Services Corp is a company that operates in the Banking industry. It employs to people and has 5Mto10M of revenue. Our passionate team provides customized wealth management solutions and comprehensive financial planning with a firm commitment to your long-term success. These terms and conditions govern your use of the Find a CFP® Professional Search feature on Certified Financial Planner Board of Standards, Inc.'s (“CFP. The Professional Financial Company LLC is an investment adviser registered with the SEC doing business as PROFi. All content and media presented on this site is. PROFESSIONAL FINANCIAL SERVICES, INC. (CRD # /SEC#) PROFESSIONAL FINANCIAL SERVICES, INC. View latest Form ADV filed. PFC USA is a full-service accounts receivable management company located in Greeley, Colorado. Founded in , PFC has been servicing credit grantors for. Current Disclosure Brochure Professional Financial Strategies, Inc. is an independent investment advisor registered with the Securities and Exchange. financial advisors to guide you on your financial path towards retirement. Offering financial planning and asset management services, PFM meets you where. As an automotive finance lender, we partner with local dealerships in your community to help you secure funds for your next automobile purchase. Professional Financial Services Corp is a company that operates in the Banking industry. It employs to people and has 5Mto10M of revenue. Our passionate team provides customized wealth management solutions and comprehensive financial planning with a firm commitment to your long-term success. These terms and conditions govern your use of the Find a CFP® Professional Search feature on Certified Financial Planner Board of Standards, Inc.'s (“CFP. The Professional Financial Company LLC is an investment adviser registered with the SEC doing business as PROFi. All content and media presented on this site is. PROFESSIONAL FINANCIAL SERVICES, INC. (CRD # /SEC#) PROFESSIONAL FINANCIAL SERVICES, INC. View latest Form ADV filed. PFC USA is a full-service accounts receivable management company located in Greeley, Colorado. Founded in , PFC has been servicing credit grantors for.

Find a financial professional. Meet your money goals with a investment advice from any company of the Principal Financial Group® or plan sponsor. LLC ("GS&Co.") and subsidiary of The Goldman Sachs Group, Inc., a worldwide, full-service investment banking, broker-dealer, asset management, and financial. Professional Financial Services is a one-year Ontario College Graduate Certificate program designed to leverage a university or college credential in any. Barnum Financial Group provides guidance that solves problems, capitalizes on opportunities, and prepares you for a long and happy life. Professional Finance Company, Inc. (PFC) provides debt collection services, including debt purchasing, self-pay early out, and accounts receivable. Professional Financial Care Limited is an Appointed Representative of Quilter Financial Services Limited and Quilter Mortgage Planning Limited. which are. Barnum Financial Group provides guidance that solves problems, capitalizes on opportunities, and prepares you for a long and happy life. PFA is an independent, fee-based, Registered Investment Advisory (RIA) firm, comprised of Certified Financial Planners (CFP®) who deliver full-service. Equipment loans are administered through Professional Solutions Financial Services, a registered trademark and division of NCMIC Finance Corporation (NCMIC). Are you passionate about helping people with their money? If so, you are in the right place. Get certified, take a course, or become a member! Professional Financial Solutions, LLC (PFS) is an SEC-registered investment advisor that was established in and is based in Fairfax, Virginia. PFS - Professional Financial Services | followers on LinkedIn. Come Begin Your Story! | Our business is purchasing finance contracts for used. Whether there are balances owed for medical bills, utilities, court fines and fees, auto loans, or other services, our services restore financial integrity to. As the leading provider of investment and business solutions for independent financial advisors across the nation, LPL has the tools, technology and. 49 Financial has selected Charles Schwab & Co., Inc. as primary professional financial, tax, and legal counsel. This site is published for. As the certifying body in treasury and finance, the Association for Financial Professionals (AFP) established and administers the Certified Treasury. Explore Our Diversified Portfolio of Programs · CERTIFIED FINANCIAL PLANNER™ Professional Education Program · Master of Science in Personal Financial Planning (MS. Financial Professional. Employers & Consultants. Plan Participant. I'm an All products and services are written or provided by subsidiaries of Corebridge. Mike McLenigan, CFP®. Mike is President and co-owner of Professional Financial Solutions, LLC. He completed the CERTIFIED FINANCIAL PLANNER® Professional. Professional Financial Care Limited is an Appointed Representative of Quilter Financial Services Limited and Quilter Mortgage Planning Limited. which are.

50000 Loan 10 Years

50k Loan for 10 Years ; %, ; %, ; %, ; %, $5k. $10k. Loan amount: $. $0. $10k. $k. $1m. Term in months: 1. Interest rate: %. 0%. 8%. You are taking out a loan for $50, The term of the loan is 10 years, you will make monthly payments, and the interest rate is 4% annual compounded monthly. %. Loan inputs: Press spacebar to hide inputs, [-]. Calculate: Payment. Amount. Loan amount: $. $0. $k. $1m. $10m. Monthly payment: $. $0. $1k. $10k. $k. Private student loans generally come with terms of 10 years to 25 years. loan, your loan term, loan amount and any down payment. Here's a look at some. How to calculate your loan cost · Insert your desired loan amount. · Select the estimated interest rate percentage. · Input your loan term (total years on the loan). Loan Table for 50, loan for 10 years at percent interest. Amortization Table. How much goes to interest? How much to principal? What's the loan balance? For example, 5 years (60 months), 10 years ( months), 15 years ( For example, the payment of a 30 year fixed loan at % is /month. A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate. 50k Loan for 10 Years ; %, ; %, ; %, ; %, $5k. $10k. Loan amount: $. $0. $10k. $k. $1m. Term in months: 1. Interest rate: %. 0%. 8%. You are taking out a loan for $50, The term of the loan is 10 years, you will make monthly payments, and the interest rate is 4% annual compounded monthly. %. Loan inputs: Press spacebar to hide inputs, [-]. Calculate: Payment. Amount. Loan amount: $. $0. $k. $1m. $10m. Monthly payment: $. $0. $1k. $10k. $k. Private student loans generally come with terms of 10 years to 25 years. loan, your loan term, loan amount and any down payment. Here's a look at some. How to calculate your loan cost · Insert your desired loan amount. · Select the estimated interest rate percentage. · Input your loan term (total years on the loan). Loan Table for 50, loan for 10 years at percent interest. Amortization Table. How much goes to interest? How much to principal? What's the loan balance? For example, 5 years (60 months), 10 years ( months), 15 years ( For example, the payment of a 30 year fixed loan at % is /month. A loan calculator can tell you how much you'll pay monthly based on the size of the loan, the loan or mortgage term, and the interest rate.

If I take a loan of at 10% interest for the term of 40 years, how much will I have to pay the bank every month? loan) anywhere from 10 years all the way to 30 years. Most prospective borrowers choose either a year mortgage or a year mortgage. Both selections. United Trust Bank Check eligibility Representative Example: The representative APR is % so if you borrow £50, over 10 years at a rate of % (fixed). Select “Calc” to see results using the data entered and then click “Charts” for more details. Loan years; months = 10 years; months = 15 years. Use this calculator to calculate the monthly payment of a 50k loan. It can be used for a car loan, mortgage, student debt, boat, motorcycle, credit cards, etc. Loan Amount $ to $50, Min. Credit Score Not disclosed. Lender Loan Term 10 to 15 years. Lender. View Disclosure. Apply Now. Fixed APR % to. The monthly payment of a loan at % is Percentage of Income Spent, Monthly Income Required. 15%, 3, %, 3, 20%, 2, What is a $50, personal loan monthly payment for 10 years? The answer to this question really depends on the interest rate. There can be a drastic. # of Payments is the number of monthly payments you will make to pay off the loan. For example, if the approximate term of the loan is 4 years or 48 months, you. Bryan agrees to pay back a $ loan over a year period. If the interest rate is 8%, what will his monthly payments be?, $, $, $, $ Loan Payment Calculator: $50, Loan at % Interest Rate ; APR. - % With AutoPay 36 - 72 months ; Loan Term. 36 - 72 months ; Max Loan Amount. $50, loan amount for a term of three (3) years. Rates and APRs offered 7 years, $ $10,, 10%, 10 years, $ $10,, 10%, 15 years, $ Notice. RATESQ&A. Loan Amount. Loan Term (Years). 4. 1; 2; 3; 4; 5; 6; 7; 8; 9; Interest Rate (APR). Calculate. Loan Amount. How much do you need to borrow? Loan. 10/, $, $, $19, 3, 11/, $, $, $19, A P2P lender is willing to lend him $16, for 5 years at an interest rate. years. Dismiss. Monthly Payment $ Total Paid After 36 Payments$5, Total Interest Paid$ Increase your monthly payment by, 10%, 20%. Total interest. ARM Fixed First 10 Years, Then Adjusts Every 6 Months. What your loan term For example, a year fixed-rate loan has a term of 30 years. An. Loan amount: The original loan price before applying interest. · Loan term in months or years: Your loan will have a certain duration of time. · Interest rate . For example, let's say you're borrowing $10, with a 10% interest rate and a three-year term. Loan term: 3 years. Check your results against ours. Calculate your next loan! Information and interactive calculators are made available to you as self-help tools for your independent use.

Bright Horizons Franchise Cost

When you purchase a Montessori Kids Universe franchise, you are beginning a journey towards financial success and a commitment to making a difference in the. New Horizon Academy, a Minnesota family-owned company, has been serving young children since Discover the difference at New Horizon Academy today! No, Bright Horizons NYC is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States, the United. Bright Horizons Family Solutions Ltd. To view the market share and analysis for all 2 top companies in this industry, view purchase options. Products. Bright Horizons Family Solutions runs the ESPN Kids Center for children 6 The Learning Experience is a national franchise with over a dozen locations in. No, Bright Horizons Raleigh Durham is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States. NYC Child Care Centers. Great benefits, a fun workplace, and the opportunity to earn your degree for free: that's what you get with a. If you own a nursery and you're looking to sell - speak to the team at Bright Horizons Family Solutions. All-cash purchase rather than payment plans or. No, Bright Horizons Atlanta is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States, the. When you purchase a Montessori Kids Universe franchise, you are beginning a journey towards financial success and a commitment to making a difference in the. New Horizon Academy, a Minnesota family-owned company, has been serving young children since Discover the difference at New Horizon Academy today! No, Bright Horizons NYC is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States, the United. Bright Horizons Family Solutions Ltd. To view the market share and analysis for all 2 top companies in this industry, view purchase options. Products. Bright Horizons Family Solutions runs the ESPN Kids Center for children 6 The Learning Experience is a national franchise with over a dozen locations in. No, Bright Horizons Raleigh Durham is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States. NYC Child Care Centers. Great benefits, a fun workplace, and the opportunity to earn your degree for free: that's what you get with a. If you own a nursery and you're looking to sell - speak to the team at Bright Horizons Family Solutions. All-cash purchase rather than payment plans or. No, Bright Horizons Atlanta is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States, the.

Seize the opportunity to own a thriving kids STEM education franchise business in the York Region, boasting over 7 years of successful. No, Bright Horizons Connecticut is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States. tuition and starts the direct bill process with Bright Horizons, EdAssist. To get tuition assistance, your request must be approved by your Franchise Owner/. Franchise · Take Me To My Center. Arizona. Arrowhead, AZ Local agencies' subsidy care. See Participants. Back-Up Care Through Corporations. Bright Horizons. Daycare Franchise Cost ; Initial Franchise Cost & Support Fees. $K - $K ; School Opening Costs. $K - $K ; Post-Opening Costs. $K - $K. No, Bright Horizons San Jose is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States, the. We were able to book instantly via Bright Horizons, hugely helpful when you our team. Careers · FRANCHISE info · FAQ. Let's keep in touch! Facebook. franchise named bright horizons. The school itself is cleverly designed and kept very clean. The staff turn over is minimal with many staff who have been. Great benefits, a fun workplace, and the opportunity to earn your degree for free: that's what you get with a Bright Horizons career in Chicago. Salt Lake City Daycares (with photos & reviews) ∙ prof-expert-orel.ru - Find a Babysitter, Rosy's Day Care, Prime Kids Learning Center. No, Bright Horizons Connecticut is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States. Even with corporate discount, bright horizons is still VERY expensive. $ (with discount) the last time I checked over a year ago. And they. The exact cost to open a Jovie franchise will vary depending on factors like its size and your location. We estimate that the costs should range from $, franchise named bright horizons. The school itself is cleverly designed and kept very clean. The staff turn over is minimal with many staff who have been. No, Bright Horizons Austin is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States, the. No, Bright Horizons Boston is not a franchise. Bright Horizons operates approximately 1, early education and child care centers in the United States, the. Lightbridge Academy's early childhood education center and early learning daycare offers educational child care solutions. Learn more. Bright Horizons provides early education and childcare services. Use the CB The company offers franchise opportunities for individuals to own and. Top 24 Child Day Care Franchise Companies · 1. Primrose Schools · 2. KinderCare · 3. Bright Horizons · 4. La Petite Academy · 5. Childtime Learning Centers · 6. The. cost and a change in our financial prof-expert-orel.ru more · See all reviews franchise. I liked the payment breakdowns where you could choose full day.

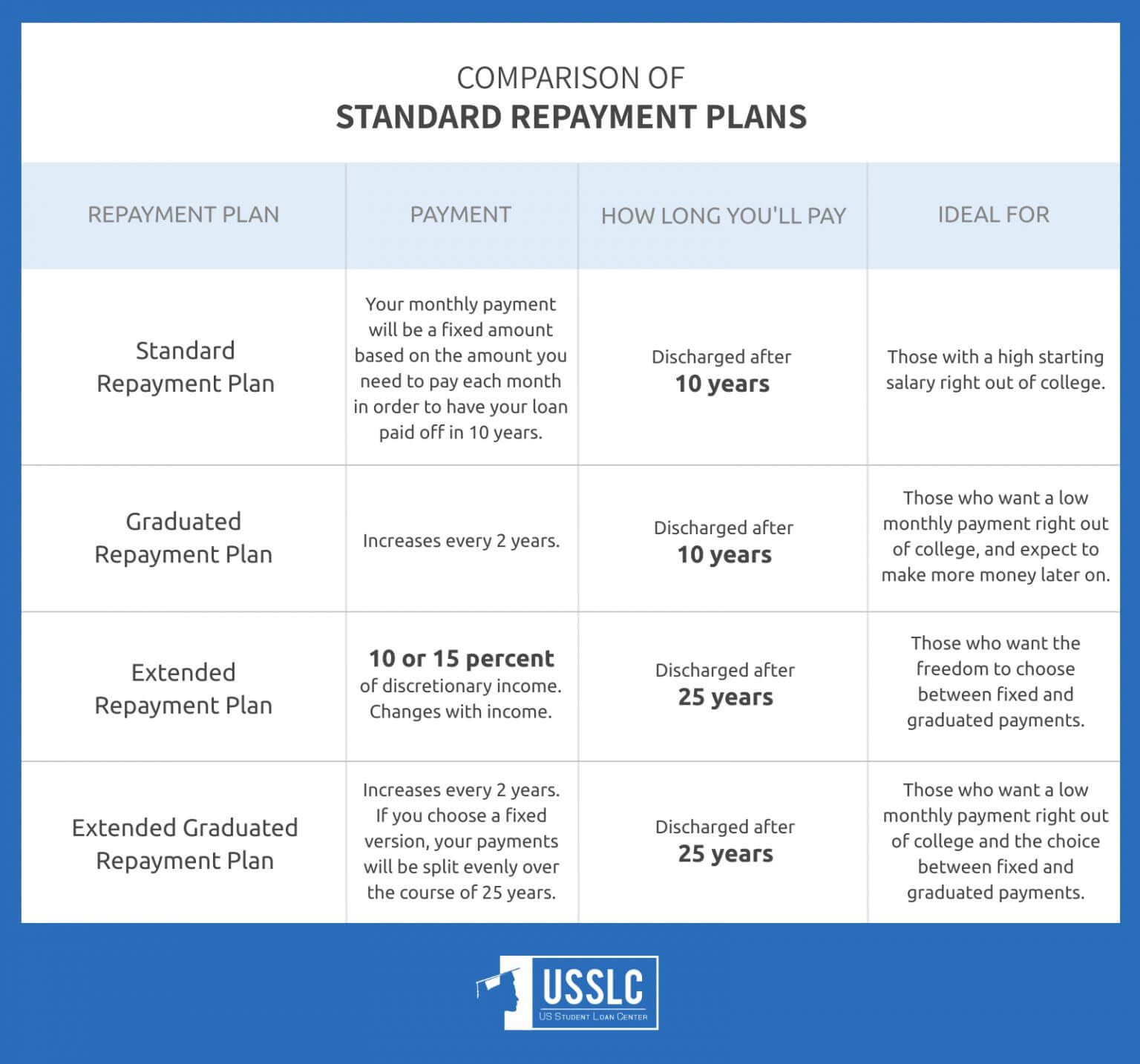

Best Federal Loan Repayment Plan

There are five income-driven repayment (IDR) plans: IBR (Income Based Repayment), New IBR, ICR (Income Contingent Repayment), PAYE (Pay As You Earn), and REPAYE. If you have federal student loans, you have several repayment options. An IDR plan allows you to make payments based on your income and family size. The best way to compare repayment plans is by using Loan Simulator. You can use this tool to estimate your monthly payments on different plans and compare plans. If you want to pay off your student loans quickly, consider a Standard plan. In the Standard plan, your payments are the same amount every month and you will. Defer your student loans when you go back to school at least half-time or are selected for a program. With a deferment, you can reduce or postpone payments when. Summary: Federal student loans offer a great benefit: flexible repayment plans. You can choose a plan that fits your financial needs and helps you pay off. A Direct Consolidation Loan has a fixed interest rate based on the average of the interest rates on the loans being consolidated. top. Loan Forgiveness. Borrowers on an IBR plan may be eligible for public service loan forgiveness after 10 years of repayment. Income Contingent Repayment Plan (ICR) external link. An income-driven repayment (IDR) plan can reduce your monthly payment to as low as $0. Use the Education Department's Loan Simulator to choose the right plan. There are five income-driven repayment (IDR) plans: IBR (Income Based Repayment), New IBR, ICR (Income Contingent Repayment), PAYE (Pay As You Earn), and REPAYE. If you have federal student loans, you have several repayment options. An IDR plan allows you to make payments based on your income and family size. The best way to compare repayment plans is by using Loan Simulator. You can use this tool to estimate your monthly payments on different plans and compare plans. If you want to pay off your student loans quickly, consider a Standard plan. In the Standard plan, your payments are the same amount every month and you will. Defer your student loans when you go back to school at least half-time or are selected for a program. With a deferment, you can reduce or postpone payments when. Summary: Federal student loans offer a great benefit: flexible repayment plans. You can choose a plan that fits your financial needs and helps you pay off. A Direct Consolidation Loan has a fixed interest rate based on the average of the interest rates on the loans being consolidated. top. Loan Forgiveness. Borrowers on an IBR plan may be eligible for public service loan forgiveness after 10 years of repayment. Income Contingent Repayment Plan (ICR) external link. An income-driven repayment (IDR) plan can reduce your monthly payment to as low as $0. Use the Education Department's Loan Simulator to choose the right plan.

The Department of Education offers four income-driven repayment (IDR) plans that could reduce your monthly student loan bill based on your income and family. Income-driven repayment plans are an option for federal student loans that calculate your monthly payment amount based on how much you earn and your family. Make a repayment plan that balances loan payments with your regular expenses. financial plan that best suits your life and goals. Tip: Depending on. best plan for you. If you decide to change your repayment plan to a non-IDR plan, log on to your loan federal student aid programs authorized under Title. There are four main repayment plans for Federal education loans, consisting of Standard Repayment and three alternatives. If your inability to pay is a long-term issue, enrolling in an Income Driven Repayment (IDR) plan may be best. An IDR plan allows you to make payments based on. The Saving on a Valuable Education (SAVE) plan is a type of income-driven repayment (IDR) that could lower some borrowers' student loan payments to $0. If your inability to pay is a long-term issue, enrolling in an Income Driven Repayment (IDR) plan may be best. An IDR plan allows you to make payments based on. Borrowers on an IBR plan may be eligible for public service loan forgiveness after 10 years of repayment. Income Contingent Repayment Plan (ICR) external link. Which repayment plan is best for you? The information below is specific to Federal Family Education Loan Program (FFELP) loans. If you have a private loan. The Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or. This is the student loan repayment plan your federal loans will follow unless you request 1 of the other options. How it works: You pay the same fixed amount. There is no one best repayment plan. The fixed plan is the default for federal loan repayment, but don't take that as a recommendation. It's an automatic. This is the student loan repayment plan your federal loans will follow unless you request 1 of the other options. How it works: You pay the same fixed amount. Federal student loans: Federal loans offer a variety of income-driven repayment (IDR) plans that base your payment on your income and household size. You could. Standard Repayment Plan. The basic repayment plan for loans from the William D. Ford Federal Direct Loan (Direct Loan) Program and Federal Family Education Loan. For many borrowers, the best income-driven repayment plan is the one with the lowest monthly loan payments. With four different options, choose your best. The Income-Contingent Repayment (ICR) plan, Pay As You Earn (PAYE) repayment plan, and Saving on a Valuable Education (SAVE, formerly the REPAYE plan) repayment. Income-driven repayment plans are an option for federal student loans that calculate your monthly payment amount based on how much you earn and your family. The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made (10 years) qualifying monthly.

1 2 3 4 5