prof-expert-orel.ru

Prices

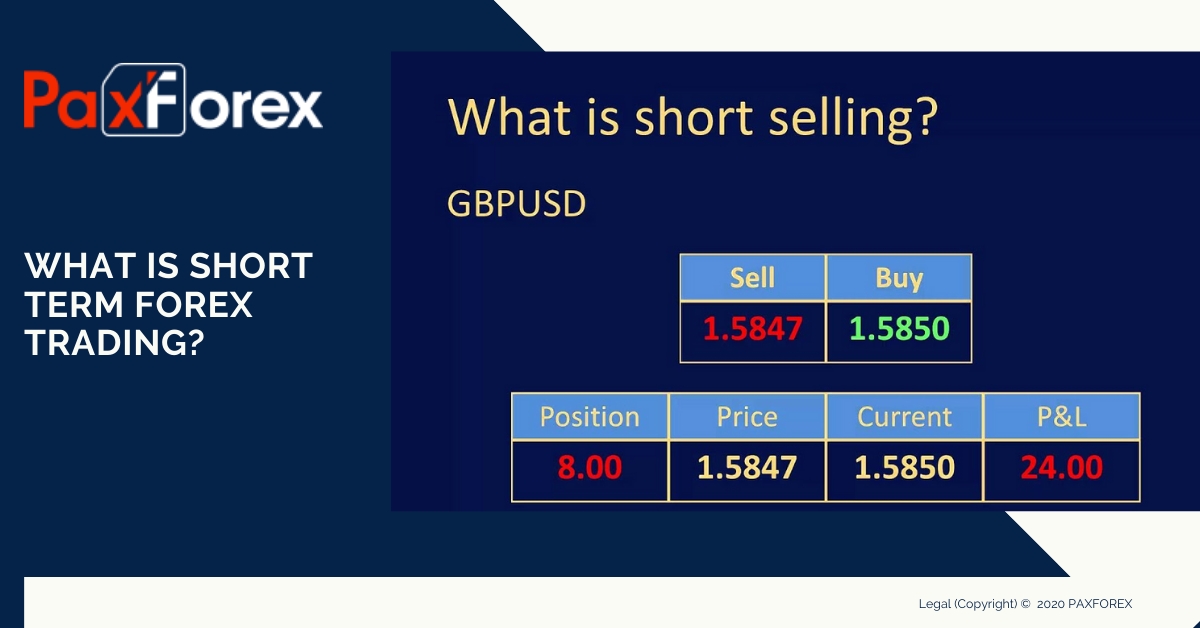

Forex Short Term Trading

Short-term trading means any timeframe from 5 minutes to 5 days. True False. The best Forex traders swear by daily charts over more short-term strategies. Compared to the Forex 1-hour trading strategy, or even those with lower time-. This article will provide traders with a brief guide to short-term Forex trading strategies. It will look at what short-term trading is, the different types. In Forex trading, you can take long or short positions based on expectations of the market rising or falling. Long or buy positions are maintained when traders. The Intraday method to start Forex day trading is a type of trading style in which a position is kept open for no more than 24 hours without keeping it. Day trading is an approach to the markets that involves opening and closing positions within a single day. How much you trade is up to you: you could stick to. When swing trading, you're aiming to profit from a small part of a longer trend within a given market. Even within strong bull or bear moves, most assets see. If you want to trade for short periods, but aren't comfortable with the fast-paced nature of scalping, day trading is an alternative forex trading strategy. Traders seek to capitalize on short-term price trends and may hold positions for a few seconds (scalping), minutes, hours (day trading), or days to weeks (swing. Short-term trading means any timeframe from 5 minutes to 5 days. True False. The best Forex traders swear by daily charts over more short-term strategies. Compared to the Forex 1-hour trading strategy, or even those with lower time-. This article will provide traders with a brief guide to short-term Forex trading strategies. It will look at what short-term trading is, the different types. In Forex trading, you can take long or short positions based on expectations of the market rising or falling. Long or buy positions are maintained when traders. The Intraday method to start Forex day trading is a type of trading style in which a position is kept open for no more than 24 hours without keeping it. Day trading is an approach to the markets that involves opening and closing positions within a single day. How much you trade is up to you: you could stick to. When swing trading, you're aiming to profit from a small part of a longer trend within a given market. Even within strong bull or bear moves, most assets see. If you want to trade for short periods, but aren't comfortable with the fast-paced nature of scalping, day trading is an alternative forex trading strategy. Traders seek to capitalize on short-term price trends and may hold positions for a few seconds (scalping), minutes, hours (day trading), or days to weeks (swing.

The best way to make short-term profits in the stock market is to trade around key economic data releases and earnings reports. That's how you do short-term. Swing Trading Swing trading refers to the medium-term trading style that is used by forex traders who try to profit from price swings. It is trading style. If you consider financial markets as a part-time activity to gain extra revenue, short-term trading strategies seem to be the most suitable. You don't have to stick to short-term strategies with FX, though. Many swing traders like to focus on one or two currency markets, hunting for medium-term price. Short-term trading can be very lucrative but it can also be risky. A short-term trade can last for as little as a few minutes to as long as several days. In the forex market, you can hold a position for anything from a few minutes to many years. It will depend on your trading style, your appetite for risk, and. A swing trader is not concerned with the long-term value of a currency; they are instead looking to profit simply from peaks and dips in momentum. The high. Forex scalping strategy. Forex scalping strategies take advantage of forex market volatility and involve opening and closing trades in quick succession, with. Forex day trading strategies for beginners · 3. Scalping · 4. Mean reversion · 5. Money flows · 1. Choose how to day trade · 2. Create a day trading plan · 3. Yes, short-term profits are possible in Forex trading. Capitalizing on currency fluctuations, traders use technical analysis, chart patterns. It is a popular trading strategy where you buy and sell over a time frame of a single day's trading with the intention of profiting from small price movements. Support and resistance trading is one of the best ways to approach the Forex market in the short term. The idea behind this technical approach is to look for. There may be some degree of technical analysis involved, both it is not as pronounced when compared to short-term forex trading where technical analysis. Higher Volume in Each Trade – In order for a scalper to profit significantly from short term moves, a larger position must often be taken in order to make the. Perhaps the most popular short-term trading market is Forex, due to the sheer number of currency pairs that are available to trade 24 hours a. Forex pairs help exchange one currency for another to hedge exposure or speculate on global economies. globe at night with lights in cities. Why trade forex? Longer term trades can help you tide over unexpected volatility generated in scalping and intraday trading. However, with the higher profit potential, there is. 3 Advantages of Short-Term Forex Trading. Trading on short-term periods in Forex market is often considered to be a more popular practice than long-term trading. Day trading for a living is not easy and it's not difficult. If you understand fundamental and technical analysis, a little bit of supply and.

How To Buy Ipo Shares

No brokerage firm can guarantee you will be able to purchase shares in an initial public offering (IPO). While it can be difficult for individual investors. To invest in IPO shares, you must first open a Demat account as well as a trading account. Only Demat accounts are typically required to purchase shares in an. The only requirement is to have sufficient capital in your account to purchase stock. Once the stock is listed, shares can be purchased by the general public in. Stocks don't always begin trading at market open on the day of their IPO. Expect delays while the exchange processes all of the orders relating to the new stock. buy IPO shares for a number of reasons buy IPO shares for a number of reasons: The Underwriting Process. The IPOs of all but the smallest of companies. How To Apply for an IPO Online Through Angel One? · Login to the Angel One App or website and click on 'IPO' on the homepage. · Select the IPO you are interested. To buy shares, you need to place a bid prior. Note that you can bid only as per the lot size mentioned in the prospectus. The lot size is the minimum quantity. How do I participate in IPO stock? · 1. Have a TradeStation equities brokerage account with a minimum balance of $ · 2. Download the ClickIPO app from the. Once you have access, you can submit a request or conditional offer to buy (COB) for IPO shares from select companies from within the app. How to sign up for. No brokerage firm can guarantee you will be able to purchase shares in an initial public offering (IPO). While it can be difficult for individual investors. To invest in IPO shares, you must first open a Demat account as well as a trading account. Only Demat accounts are typically required to purchase shares in an. The only requirement is to have sufficient capital in your account to purchase stock. Once the stock is listed, shares can be purchased by the general public in. Stocks don't always begin trading at market open on the day of their IPO. Expect delays while the exchange processes all of the orders relating to the new stock. buy IPO shares for a number of reasons buy IPO shares for a number of reasons: The Underwriting Process. The IPOs of all but the smallest of companies. How To Apply for an IPO Online Through Angel One? · Login to the Angel One App or website and click on 'IPO' on the homepage. · Select the IPO you are interested. To buy shares, you need to place a bid prior. Note that you can bid only as per the lot size mentioned in the prospectus. The lot size is the minimum quantity. How do I participate in IPO stock? · 1. Have a TradeStation equities brokerage account with a minimum balance of $ · 2. Download the ClickIPO app from the. Once you have access, you can submit a request or conditional offer to buy (COB) for IPO shares from select companies from within the app. How to sign up for.

IPO Access lets you buy shares at the IPO price as the stock becomes available to the general public. With our random allocation process, each customer's. IPO is the Initial Public Offering of the stocks of the issuing company on the stock market. It's a process companies use to distribute their stock shares. An IPO application can be submitted through Zerodha from Kite web or Kite app using any UPI application. Visit prof-expert-orel.ru to know. "IPO subscription" means that an investor participates in an IPO and has the opportunity to buy shares at the finalized offering price on a listing day. Unlike. IPO trading strategies · Check the price discovery on day one · Wait for the lock-up period to end · 'Buy' or 'sell' the IPO stock with derivatives. If you'd like to apply for an Initial Public Offering (IPO), just visit our page, where you can find more details of the available IPOs. Key Factors to Consider Before Buying an IPO · Company's Financial Position: Examine the company's financial statements. · Thoroughly Review the Prospectus. Participating in an IPO involves buying a company's stock at the offering price—meaning before it actually begins trading. Unfortunately, not everyone will have. Selecting the IPO · Arranging funds · Opening a Demat and Trading account · Applying for the IPO · Placing your bid · Allotment of shares · Summing up. Secure IPO shares at the IPO price How to buy Crypto · Buy T-bills. © Copyright Public Holdings, Inc. All Rights Reserved. IPO investing will be. Most IPO shares typically go to institutional investors. Brokerages divvy up the rest to retail investors. Initial trading days can offer strong performance. On this day, depending on share availability, purchases can be made through a brokerage account. An alternative for individual investors to purchase stock. How can I purchase an IPO after it launches publicly? Once a company is publicly trading on an exchange, the process is as simple as placing an order on your. After investing in an IPO, investors can sell the shares (or buy more) on a securities exchange such as the Australian Securities Exchange (ASX). IPOs: the. An investor could place an order with his or her broker to purchase shares in this manner. How do I learn about the company? A company undertaking an IPO. 5 Tips for Investing in IPOs · Participating in an IPO · 1. Dig Deep for Objective Research · 2. Pick a Company With Strong Brokers · 3. Always Read the Prospectus. The IPO process starts when a company decides that it wants to sell its shares to the public via a stock exchange. First, an audit must be conducted, which. Forming a price. This brings us to the annoying situation in which you can't buy IPO shares as soon as the market opens. What happens is that the IPO investors. After the IPO shares are issued to investors to raise capital and begin trading, the general public can buy or sell shares through a stock exchange. Why Do. In order to obtain shares in an IPO, also known as an initial public offering, you must understand how to buy them. The main flow is opening a securities.

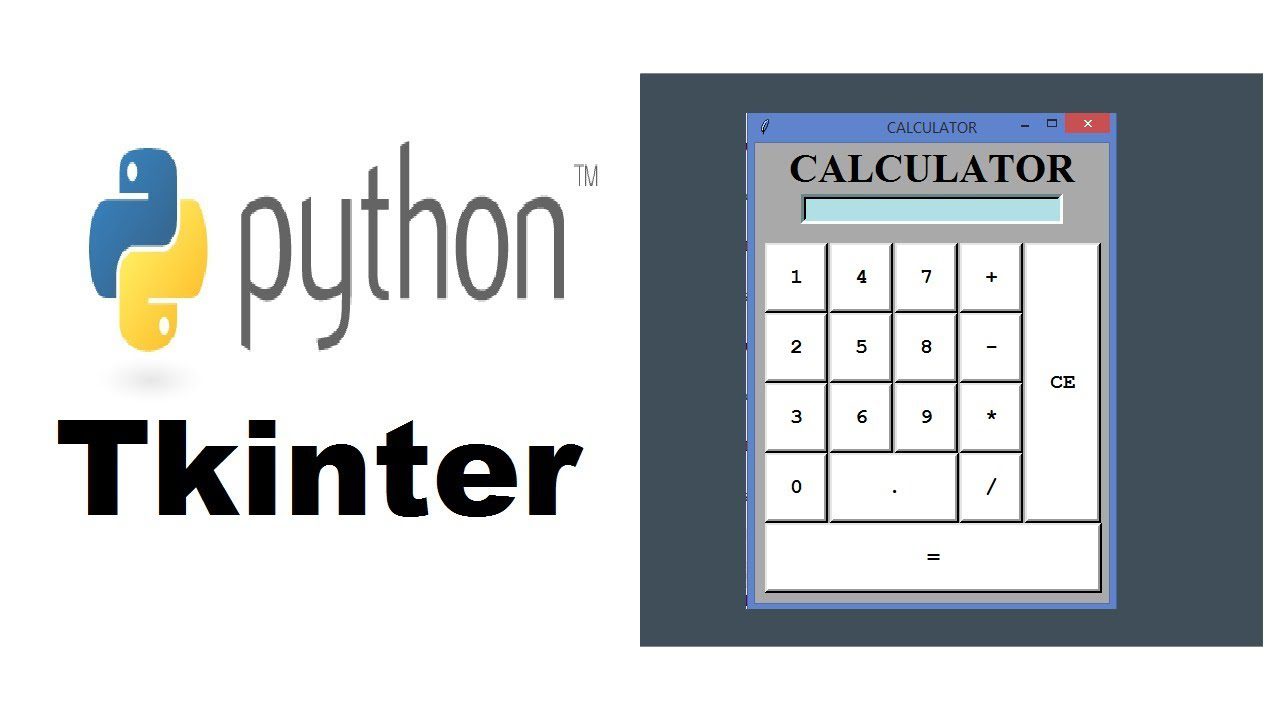

Tkinter Tutorial Python

In the Python programming language, Tkinter stands out as a standard library for building GUIs. This hands-on guide will walk you through the. CustomTkinter is a python UI-library based on Tkinter, which provides new, modern and fully customizable widgets. I just asked this same question in the last Ask Anything thread. Several years of Python under my belt and I still feel the pain with Tkinter. Why Learn Tkinter? · Tkinter is a powerful standard library of Python that is used to create GUI (Graphical User Interface). · Tkinter allows you to create. The tkinter package (“Tk interface”) is the standard Python interface to the Tcl/Tk GUI toolkit. Both Tk and tkinter are available on most Unix platforms. Tkinter is Python's built-in library for creating graphical user interfaces (GUIs). It's a powerful and versatile toolkit that allows you to. Tkinter Tutorial to help us ❤️ pay for the web hosting fee and CDN to keep the website running. This Tkinter tutorial introduces you to the exciting world of. Tkinter is the Python port for Tcl-Tk GUI toolkit developed by Fredrik Lundh. This module is bundled with standard distributions of Python for all platforms. Python Tkinter Tutorial with python tutorial, tkinter, button, overview, entry, checkbutton, canvas, frame, environment set-up, first python program. In the Python programming language, Tkinter stands out as a standard library for building GUIs. This hands-on guide will walk you through the. CustomTkinter is a python UI-library based on Tkinter, which provides new, modern and fully customizable widgets. I just asked this same question in the last Ask Anything thread. Several years of Python under my belt and I still feel the pain with Tkinter. Why Learn Tkinter? · Tkinter is a powerful standard library of Python that is used to create GUI (Graphical User Interface). · Tkinter allows you to create. The tkinter package (“Tk interface”) is the standard Python interface to the Tcl/Tk GUI toolkit. Both Tk and tkinter are available on most Unix platforms. Tkinter is Python's built-in library for creating graphical user interfaces (GUIs). It's a powerful and versatile toolkit that allows you to. Tkinter Tutorial to help us ❤️ pay for the web hosting fee and CDN to keep the website running. This Tkinter tutorial introduces you to the exciting world of. Tkinter is the Python port for Tcl-Tk GUI toolkit developed by Fredrik Lundh. This module is bundled with standard distributions of Python for all platforms. Python Tkinter Tutorial with python tutorial, tkinter, button, overview, entry, checkbutton, canvas, frame, environment set-up, first python program.

Tkinter is a graphical user interface (GUI) module for Python, you can make desktop apps with Python. You can make windows, buttons, show text and images. Python GUI Development with Tkinter is your comprehensive guide to mastering the art of crafting captivating user experiences. This book takes you on an. Well organized and easy to understand Web building tutorials with lots of examples of how to use HTML, CSS, JavaScript, SQL, Python, PHP, Bootstrap, Java. Learn Tkinter With Projects | Python Tkinter GUI Tutorial In Hindi #0. In this course, you are going to learn how to create GUI apps in Python using Tkinter. Tkinter Programming. Tkinter is the standard GUI library for Python. Python when combined with Tkinter provides a fast and easy way to create GUI applications. In this tutorial, you'll learn the basics of GUI programming with Tkinter, the de facto Python GUI framework. Master GUI programming concepts such as. Python backend development using the SQLite database (the data you type into the GUI is stored in a database, so you learn about database design. Run the program from the command line with python tkinter_prof-expert-orel.ru You should see a new window pop up with the phrase "Hello, World!" If you expand the window. In this tutorial, you are going to learn how to create GUI apps in Python. You'll also learn about all the elements needed to develop GUI apps in Python. In this chapter we will use tkinter, a module in the Python standard library which serves as an interface to Tk, a simple toolkit. Modern Tk Tutorial for Python, Tcl, Ruby, and Perl. If you've found this tutorial useful, please check out Modern Tkinter. Creative Commons License. The tkinter module is a wrapper around tk, which is a wrapper around tcl, which is what is used to create windows and graphical user interfaces. Here, we show. The tkinter module is a wrapper around tk, which is a wrapper around tcl, which is what is used to create windows and graphical user interfaces. Here, we show. The tkinter package is a thin object-oriented layer on top of Tcl/Tk. To use tkinter, you don't need to write Tcl code, but you will need to consult the Tk. Tkinter is an easy way to write GUIs in Python. Unlike bigger GUI toolkits like Qt and GTK+, tkinter comes with Python so many Python users have it already. In the Python programming language, Tkinter stands out as a standard library for building GUIs. This hands-on guide will walk you through the. In this Python Tkinter Tutorial, we will unravel the step-by-step process using Python GUI programming with Tkinter to navigate from basic building blocks to. Tkinter is a Python binding to the Tk GUI toolkit. It is the standard Python interface to the Tk GUI toolkit, and is Python's de facto standard GUI. Tkinter, a built-in Python module, provides a powerful and easy-to-use framework for creating GUI applications. Tkinter – GUIs in Python. Dan Fleck. CS George Mason University. Coming up: What is it? NOTE: This information is not in your textbook! See references for.

Is Investing In Etfs A Good Idea

You can't make automatic investments or withdrawals into or out of ETFs. Mutual funds. A mutual fund could be a suitable investment. You can set up automatic. The differences between this Fund and other ETFs may also have advantages. By keeping certain information about the Fund secret, this Fund may face less risk. ETFs are baskets of stocks or securities, but although this means that they are generally well diversified, some ETFs invest in very risky sectors or employ. As a result, they are among the best-suggested investment vehicles for long-term investors. You can learn how Exchange Traded Funds (ETFs) can help you meet. When it comes to risk considerations, many investors opt for ETFs because they feel that they are less risky than other modes of investment. We've already. Like all investments, ETFs present a number of benefit and risks for investors depending on your investment style, knowledge level, risk tolerance. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF. Whether ETFs are a good investment, depends on which ETF you buy. Just as with stocks or funds, they are neither all a good investments or all bad. The positive. You can't make automatic investments or withdrawals into or out of ETFs. Mutual funds. A mutual fund could be a suitable investment. You can set up automatic. The differences between this Fund and other ETFs may also have advantages. By keeping certain information about the Fund secret, this Fund may face less risk. ETFs are baskets of stocks or securities, but although this means that they are generally well diversified, some ETFs invest in very risky sectors or employ. As a result, they are among the best-suggested investment vehicles for long-term investors. You can learn how Exchange Traded Funds (ETFs) can help you meet. When it comes to risk considerations, many investors opt for ETFs because they feel that they are less risky than other modes of investment. We've already. Like all investments, ETFs present a number of benefit and risks for investors depending on your investment style, knowledge level, risk tolerance. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF. Whether ETFs are a good investment, depends on which ETF you buy. Just as with stocks or funds, they are neither all a good investments or all bad. The positive.

There's more to building your portfolio than buying stocks, bonds and mutual funds. Have you considered exchange-traded funds (ETFs)?. The second point is where an ETF and a mutual fund tend to differ, as ETFs generally distribute capital gains less frequently than do comparable mutual funds. 3. A diversified ETF portfolio is an invaluable tool in investing, as it allows investors to spread their investments across multiple asset classes and manage. have thousands of choices. Before you invest in any mutual fund or ETF, you must decide whether the investment strat- egy and risks are a good fit for. ETFs can offer lower operating costs than traditional open-end funds, flexible trading, greater transparency, and better tax efficiency in taxable accounts. As. Since ETFs offer built-in diversification and don't require large amounts of capital in order to invest in a range of stocks, they are a good way to get started. Experts strongly advise (new) investors not to invest their money in individual stocks, but to diversify broadly. And this is exactly where ETFs come into play. The single biggest risk in ETFs is market risk. Like a mutual fund or a closed-end fund, ETFs are only an investment vehicle—a wrapper for their underlying. WHAT IS AN ETF? · AN ETF IS LIKE A “TEAM” · EXPLORE THE ADVANTAGES · 1) ETFs diversify investment portfolios and lower risk · 2) ETFs demystify investing · 3) ETFs. Equity ETFs invest in stocks of Canadian, U.S. or international companies. It's a good idea to weigh both the risks and benefits when determining if. Start with the ETF/mutual fund route. It gives you the great benefit of diversification. Even using funds, you can use various funds with. In fact, the average fund investor significantly underperforms the market over time, and over-trading is the main reason. So, once you buy shares of some great. Investors have a good choice of ETFs when it comes to hedging against inflation. Two of the most popular ETFs include index funds based on the Standard. Indeed, ETFs are investment vehicles containing many investments and are therefore already diversified. They also allow investors to obtain access to. WHAT IS AN ETF? · AN ETF IS LIKE A “TEAM” · EXPLORE THE ADVANTAGES · 1) ETFs diversify investment portfolios and lower risk · 2) ETFs demystify investing · 3) ETFs. An ETF provides diversification to that active manager and helps you to build a better portfolio. So regardless of the investor and their experience an ETF, if. Exchange-traded funds (ETFs) offer investors a variety of different strategies to prepare for whatever the market throws at them – Federal Reserve moves. One of the major advantages of ETFs is the fact that they typically trade very closely to NAV, as described above. By contrast, a listed investment company – or. For example, if you have invested US$10, in an ETF with a % annual expense ratio, about US$16 per year is deducted for operating expenses. It's a good. When considering purchasing an ETF, it's a good idea to go beyond the fund's name to understand the holdings in its portfolio. Most ETFs disclose their.

How To Make Money Online For Beginners Teenage

11 ways teens could make money · Selling second-hand clothes · Making jewellery · Social media manager · Sign up to paid surveys · Become an influencer · Livestream. If you have a creative skill of any kind, there are people out there who need you. Freelancing full-time isn't easy, but it's a good way to make money as a teen. Get a job in a store. Wash cars. Rake leaves. Clean out gutters. Learn how to interact well with others. Social skills are very important in. Helping Teenagers Make Money · 1. Think of jobs that you might pay someone else to do if the kids weren't there. · 2. Keep a list of small paying jobs to help. You could try freelance work like graphic design, writing, or coding. You could also consider starting a small online business, such as selling. 1. Write Articles Online. If you're a teen who likes to write, you can make money writing articles for websites and blogs. · 2. Customer Service · 3. Sell Items. Try making money off Twitch or YouTube. Start a podcast. Online tutoring, or online conversation on like italki as a community tutor for. You can try blogging, freelance, affiliate marketing You should just open a bank's account to receive your money, but it is a possible online. Teens can make money with traditional jobs like babysitting, cutting lawns, washing cars, or working part time in restaurants or retail. · Online opportunities. 11 ways teens could make money · Selling second-hand clothes · Making jewellery · Social media manager · Sign up to paid surveys · Become an influencer · Livestream. If you have a creative skill of any kind, there are people out there who need you. Freelancing full-time isn't easy, but it's a good way to make money as a teen. Get a job in a store. Wash cars. Rake leaves. Clean out gutters. Learn how to interact well with others. Social skills are very important in. Helping Teenagers Make Money · 1. Think of jobs that you might pay someone else to do if the kids weren't there. · 2. Keep a list of small paying jobs to help. You could try freelance work like graphic design, writing, or coding. You could also consider starting a small online business, such as selling. 1. Write Articles Online. If you're a teen who likes to write, you can make money writing articles for websites and blogs. · 2. Customer Service · 3. Sell Items. Try making money off Twitch or YouTube. Start a podcast. Online tutoring, or online conversation on like italki as a community tutor for. You can try blogging, freelance, affiliate marketing You should just open a bank's account to receive your money, but it is a possible online. Teens can make money with traditional jobs like babysitting, cutting lawns, washing cars, or working part time in restaurants or retail. · Online opportunities.

Tip: Join the free rewards app Swagbucks to earn cash for taking surveys, playing games, and more. Swagbucks is free and easy to join and open to users age If you have old unused stuff lying around, you can make quick bucks by selling them. For example, you could sell old electronics, video games, and DVDs online. With apps like Depop and Vinted, many young people use the money they earn to then reinvest in other items. For instance, a teen can sell an old jumper and then. 1. Write Articles Online. If you're a teen who likes to write, you can make money writing articles for websites and blogs. · 2. Customer Service · 3. Sell Items. 14 Ways to Make Money Online as a Teenager · 14 Ways to Make Money Online as a Teenager · 1. Blogging · 2. Sell Photos · 3. Affiliate Marketing · 4. Here you find the best tool to earn money online using AI. Freelancing and Remote Work: The net erases geographical barriers to employment. If you're wondering how to earn money online as a kid or a teenager, then you are in the right place. You can be a parent wanting to inspire kids to take up. Make Money Online with Honeygain Another effortless way to earn extra cash is using Honeygain and making money online. Consider it a side hustle for teenagers. One of the best online jobs for teens in is online surveys on survey sites. These platforms allow you to earn money by sharing your opinions on various. If English is your first language, you can earn big bucks for helping other teens learn it! Online tutoring is a big thing right now, and many platforms pay. What Are Jobs Teens Can Do Online? · Become a virtual assistant · Tutor online · Stream video games · Get involved in direct sales · Flip items · Create websites. like babysitting, yardwork and fast food, to online opportunities and the gig economy, teenagers have more ways to make money than ever. Learn about them here. Swagbucks (must be at least 13): Earn points by taking online surveys, watching videos, playing games, installing apps and more. Convert your points into gift. There are plenty of online and printed materials to help you grasp the basics. How to Make Money As a Teen. Entrepreneurial teens can start online businesses, such as selling crafts on Etsy. Getting a job as a teenager isn't just about earning money. It also helps you. like babysitting, yardwork and fast food, to online opportunities and the gig economy, teenagers have more ways to make money than ever. Learn about them here. The EASIEST Ways To Earn Extra Cash Online · Branded Surveys - Get paid instantly by answering simple questions. Join now! · Survey Junkie - Earn $20 fast for. Fiverr is a popular freelancing platform that allows you to make money by offering many different services (see a few examples below). Most jobs. In this class, 20 Best Ways to Make Money Online as a Teenager, we studied the best ways to earn money online and offline for teens. These income streams are. In this class, 20 Best Ways to Make Money Online as a Teenager, we studied the best ways to earn money online and offline for teens. These income streams are.

How Much Do You Pay For A Website

Templates and themes are a major reason you can often build a professional small business website in the $5,$10, range instead of $15,$20, or more. How much is the cost of maintaining the website? This cost can range from $5 to $5, per month. At BOWWE, you don't really pay for its maintenance; everything. However, a ballpark estimate would be $ - $ USD. This price range would include everything from the design of the website itself to the. The approximate cost of basic custom website development can range from USD 10, to USD 25, The average cost of a website development includes factors. Generally speaking, website costs can range from free, to over $, The cost factors to build a website depend on the type of website that you need, the. If you're working with a professional web design agency you can expect to pay between $10,$25, on average for an eCommerce website. How can you calculate. Web design prices for business websites, for example, range from $ to $,, while annual website maintenance cost can range from $ – $50, These. If you hire someone who specializes in business websites, 99% of small businesses will end up paying somewhere between $2, and $50, for their website. An. Hiring a web designer can cost between $50 to $ per hour, or you can negotiate a project-based fee. Costs vary based on the designer's. Templates and themes are a major reason you can often build a professional small business website in the $5,$10, range instead of $15,$20, or more. How much is the cost of maintaining the website? This cost can range from $5 to $5, per month. At BOWWE, you don't really pay for its maintenance; everything. However, a ballpark estimate would be $ - $ USD. This price range would include everything from the design of the website itself to the. The approximate cost of basic custom website development can range from USD 10, to USD 25, The average cost of a website development includes factors. Generally speaking, website costs can range from free, to over $, The cost factors to build a website depend on the type of website that you need, the. If you're working with a professional web design agency you can expect to pay between $10,$25, on average for an eCommerce website. How can you calculate. Web design prices for business websites, for example, range from $ to $,, while annual website maintenance cost can range from $ – $50, These. If you hire someone who specializes in business websites, 99% of small businesses will end up paying somewhere between $2, and $50, for their website. An. Hiring a web designer can cost between $50 to $ per hour, or you can negotiate a project-based fee. Costs vary based on the designer's.

Depending on what your goals are, you should be able to find a freelancer that will charge anywhere from $2, to $5, for a simple website. But that number. If you bought a domain name through website builder, you can also expect to pay anywhere from $15 to $25 per year additionally. Pros: Fast way to build a small. What we've found is that for most of our clients web development costs typically range from $10, to $30, for the initial build, although we have had. Wondering how your agency's website pricing compares to the competition? Most agencies should start at US$ But it could easily be US$ or more. On average, the cost of a website is anywhere from $ to $5, The cost of building a website can fluctuate depending on various factors, including the. As a general guideline, you can expect to pay anywhere between $ to $ for a 5-page website. This wide price range is due to the various. (You'll also need to pay for your domain name, as with the website builder option.) Web designers are best suited for more complex websites, such as large. The average price of shared hosting plans is around $/month. At Hostinger, the Premium hosting plan costs only $/month. We also offer additional. How much should you charge to redesign a website? Considering the talent and scope of the project, it is reasonable to charge between $2, and $10, to. Creating a professional business website with a website builder costs from $4 - $50+ per month per site. You will not have any extra web design costs or web. If you decide to build a site from scratch, you'll need to pay for hosting separately, the costs of which can range from $ to $ per month, depending on. Most reasonable very basic websites probably start at around $3, - $6, Remember, just because the website designer can build it quickly. Creating a website is a time investment, and it also costs money. You can expect to spend $ to $5, on building a website, depending on how much outside. Look the truth is that rebuilding a website has its costs. If it is in a simpler version, it will cost you about $15, to about $20,, however if the. Since your clients will have to pay for any future content changes (given there is no UI for them to use like they would have with WordPress), I'd say you. For a basic website we'd recommend setting aside $ a month for minor changes that may need done, while a larger companies should budget between $$10, Creating a professional business website with a website builder costs from $4 - $50+ per month per site. You will not have any extra web design costs or web. How much should you charge to redesign a website? Considering the talent and scope of the project, it is reasonable to charge between $2, and $10, to. Some web design companies might offer this service as part of their package, but otherwise, you might have to pay for a freelancer. SEO costs can vary from $ As a general guideline, you can expect to pay anywhere between $ to $ for a 5-page website. This wide price range is due to the various.

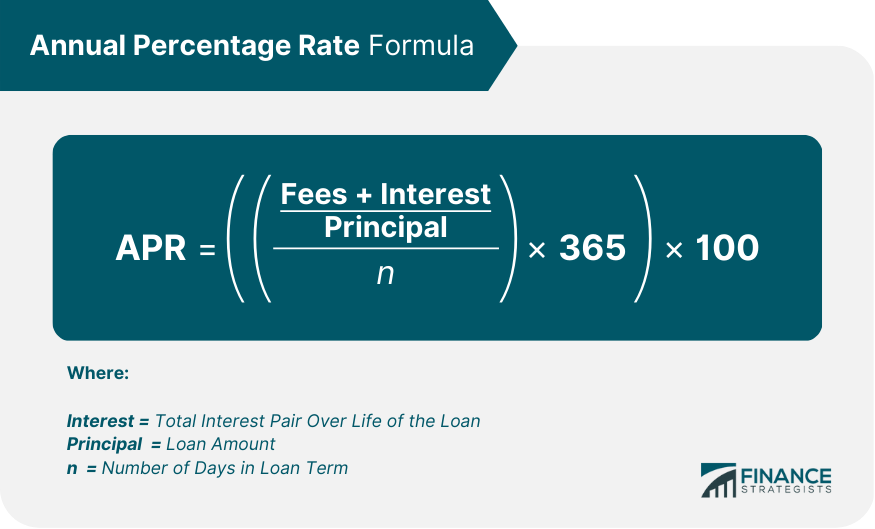

What Is Apr Percentage

A: The APR is the cost you pay each year for borrowing the money, including fees that you have to pay to get the loan, expressed as a percentage. APR is calculated over a full year and includes interest and all related fees, such as handling and service charges. Some loans, such as the HSBC Personal. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate, however. The interest rate reflects the current cost of borrowing expressed as a percentage rate. The interest rate does not reflect fees or any other charges you may. The APR associated with your credit card is your card's interest rate. In other words, it's how much extra money you'll pay on any balance you don't pay off in. Technically speaking, APR (annual percentage rate) is a numeric representation of your interest rate. When deciding between credit cards, APR can help you. An APR is a number that represents the total yearly cost of borrowing money, expressed as a percentage of the principal loan amount. Hence, instead of merely focusing on interest, lenders should pay more attention to the annual percentage rate, or real APR, when considering the actual cost of. Annual percentage rate (APR) is the annual cost of borrowing money, including fees. Learn more about how to calculate it, different types of APR and more. A: The APR is the cost you pay each year for borrowing the money, including fees that you have to pay to get the loan, expressed as a percentage. APR is calculated over a full year and includes interest and all related fees, such as handling and service charges. Some loans, such as the HSBC Personal. APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate, however. The interest rate reflects the current cost of borrowing expressed as a percentage rate. The interest rate does not reflect fees or any other charges you may. The APR associated with your credit card is your card's interest rate. In other words, it's how much extra money you'll pay on any balance you don't pay off in. Technically speaking, APR (annual percentage rate) is a numeric representation of your interest rate. When deciding between credit cards, APR can help you. An APR is a number that represents the total yearly cost of borrowing money, expressed as a percentage of the principal loan amount. Hence, instead of merely focusing on interest, lenders should pay more attention to the annual percentage rate, or real APR, when considering the actual cost of. Annual percentage rate (APR) is the annual cost of borrowing money, including fees. Learn more about how to calculate it, different types of APR and more.

APR is a percentage that indicates how much it costs to borrow money over the course of one year. This total includes the amount of the loan, interest and some. The Annual Percentage Rate (APR) is the yearly rate of interest that an individual must pay on a loan or that they receive on a deposit account. APR is the yearly cost of a loan given as a percentage of the amount borrowed. The yearly cost includes both interest and other loan fees. The interest rate charged to the borrower, excluding expenses such as account opening and account keeping fees. The APR is the basic cost of your credit as. APR is the cost of borrowing money expressed as a yearly percentage. This figure is calculated based on the loan's interest rate and any fees that are part of. The difference between an interest rate and the APR is as follows: Because the APR includes additional costs, it is typically higher than your interest rate. The annual percentage rate (APR) is a loan's yearly interest rate plus any other costs factored into the life of the loan. APR – or Annual Percentage Rate – refers to the total cost of your borrowing for a year. Importantly, it includes the standard fees and interest you'll have to. An APR is the interest rate you are charged for borrowing money. In the case of credit cards, you don't get charged interest if you pay off your balance on. Annual Percentage Rate (APR) is the annual borrowing cost of a loan or stated interest rate for a credit card. APR helps you compare loans and cards. How to. While the interest rate determines the cost of borrowing money, the annual percentage rate (APR) is a more accurate picture of total borrowing cost because it. Primary tabs. An annual percentage rate (APR) is the yearly rate charged for a loan or earned by an investment. In other words, it is a measure of the cost of. An APR is the interest rate you are charged for borrowing money. In the case of credit cards, you don't get charged interest if you pay off your balance on. If you're shopping for a loan or credit card, you may notice something called the annual percentage rate (APR). APR represents the annual cost to borrow. Credit card APR is the interest rate you're charged each month on any unpaid card balance. Learn how to calculate your daily and monthly APR. The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for. The APR is the annual rate, and the interest rate that you are charged each day is the daily periodic rate, based on your APR. The APR is a type of interest rate displayed alongside loans and credit cards that gives borrowers a clearer overview of the overall cost of debt over a year. A credit card interest rate is the price financial institutions charge for lending you money. When you buy something with a credit card, you're borrowing money. APR is the annual cost of the loan expressed as a percentage. It includes the interest rate and other costs of availing the personal loan. This gives you the.

Stop Mold In Bathroom

Mold quickly forms when moisture is present. to keep your bathroom mold-free, always ensure it's dry. I like to turn on the wall space heater. Things that help stop mould · Open windows and doors to let fresh air in and reduce humidity. · Open blinds and curtains during the day to let sunlight in. · Turn. Clean regularly. Clean bathrooms are the enemy of mold and mildew. Mopping up water, wiping down damp surfaces, and removing dirt all make it harder for fungi. Use tea tree oil to kill and prevent mould spores in your bathroom. Put a few drops in a spray bottle and use it in your tub/shower once every few weeks. You can make a paste of 3 parts baking soda to 1 part water to apply to hard-to-remove mold and mildew. Mould in the bathroom is both unsightly and unhygienic. Find out how to prevent it from forming, how to check for it and how to remove it. Spritzing down your tub and shower each day is another simple way to prevent mold and mildew buildup. Just be sure to choose a non-toxic cleaner that's safe for. How to Prevent Mold in Your Bathroom · Regulate Your Bathroom Humidity · Install a strong exhaust fan. · Ensure you drain or dry all the water out. · Ensure you. Using Baking Soda To Get Rid of Mold · Mix baking soda with small amounts of water to form a paste. · Apply the paste to the mold, let it sit for 10 minutes. Mold quickly forms when moisture is present. to keep your bathroom mold-free, always ensure it's dry. I like to turn on the wall space heater. Things that help stop mould · Open windows and doors to let fresh air in and reduce humidity. · Open blinds and curtains during the day to let sunlight in. · Turn. Clean regularly. Clean bathrooms are the enemy of mold and mildew. Mopping up water, wiping down damp surfaces, and removing dirt all make it harder for fungi. Use tea tree oil to kill and prevent mould spores in your bathroom. Put a few drops in a spray bottle and use it in your tub/shower once every few weeks. You can make a paste of 3 parts baking soda to 1 part water to apply to hard-to-remove mold and mildew. Mould in the bathroom is both unsightly and unhygienic. Find out how to prevent it from forming, how to check for it and how to remove it. Spritzing down your tub and shower each day is another simple way to prevent mold and mildew buildup. Just be sure to choose a non-toxic cleaner that's safe for. How to Prevent Mold in Your Bathroom · Regulate Your Bathroom Humidity · Install a strong exhaust fan. · Ensure you drain or dry all the water out. · Ensure you. Using Baking Soda To Get Rid of Mold · Mix baking soda with small amounts of water to form a paste. · Apply the paste to the mold, let it sit for 10 minutes.

Open windows on dry days to let fresh air blow into your home, which will reduce moisture and therefore help to prevent mould. At EnviroVent, we have a range of. Cleanliness is one of the essential factors in your bathroom to prevent mold from being present. Cleaning regularly will stop mold from getting a start in your. To prevent mould in bathrooms, you need to control and reduce condensation. The best way to do this is with improved ventilation. YSK: Mold in the bathroom can be prevented entirely by keeping the bathroom door open during/after showering. If you're renting a place with. Get a shower squeegee and use it on the walls and door if it has one. Leave the door to hall open open and if you have a fan, blow it in there. Pour undistilled white vinegar into a spray bottle and thoroughly saturate the mold. Let it sit for at least one hour to allow the mold to absorb the vinegar. Your ultimate goal will be to reduce moisture as much as possible and eliminate microscopic particles like mold spores. preventing mold on the bathroom ceiling. The best way to keep mold from flourishing in your bathroom is to control it. Molds typically have a to hour window of growing, so make sure you keep. Keep bathroom mold out of your home with a properly installed bathroom fan. Turn it on while showering and bathing and leave it on until all the moisture has. Bathroom fans are essential to preventing mold growth in your bathroom. Environix can help you rid your bathroom of mold growth long term. 5 Ways to Prevent Mold in Bathrooms · Air Out the Bathroom and Squeegee · Use Grout, Repair Leaks, Insulate Walls · Use a Dehumidifier · Launder Bathroom Items. Bathroom mold occurs primarily because mold loves damp, dark, isolated spaces,” says Larry Vetter, president of VE Science in Smithtown, NY. There are a few things you can do to get rid of mold in your bathroom, including some DIY remedies. Grab a spray bottle and mix one part hydrogen peroxide with. Use a squeegee to remove water on the shower walls and glass doors – This will not only stop the mold but keep your shower clean. If you squeegee your shower. Borax is a white mineral powder and works as a natural method to remove mold in the shower. All you have to do is mix one cup of borax with one gallon of hot. Some common household products that can be used as mould removers include vinegar, baking soda, hydrogen peroxide, bleach, and alcohol. Bathroom fans are essential to preventing mold growth in your bathroom. Environix can help you rid your bathroom of mold growth long term. Keep bathroom mold out of your home with a properly installed bathroom fan. Turn it on while showering and bathing and leave it on until all the moisture has. Use tea tree oil to kill and prevent mould spores in your bathroom. Put a few drops in a spray bottle and use it in your tub/shower once every few weeks. Your ultimate goal will be to reduce moisture as much as possible and eliminate microscopic particles like mold spores. preventing mold on the bathroom ceiling.

Ric Edelman Webinar

I would like to have an Edelman Financial Engines advisor contact me following the webinar. Ric Edelman, Co-Founder Edelman Financial Engines. - SESSION 3 -. Rose, serial entrepreneur, angel investor and Associate Founder of Singularity University, and Ric Edelman, three times ranked the #1 independent financial. Every weekend, Ric gives you the information you need about the five personal finance topics that matter most today: longevity, retirement security, exponential. In this 1-hour webinar, financial luminary Ric Edelman and well-known hedge fund manager, Anthony Scaramucci, founder of SkyBridge Capital, will reveal: How. M posts. Discover videos related to Edelman Spi Webinar Conference on TikTok. ric Links from today's show: 9/10 Webinar – Bitcoin, Ethereum, or Both? How to Make an Informed Crypto Allocation Decision: prof-expert-orel.ru Join Ric Edelman every weekday for The Truth About Your Future podcast · The Truth About Your Future with Ric Edelman Podcast · Featuring Ric · Webinar Replays. Free, live webinar TODAY at 3pm ET! I'll be joined by Matt Hougan of Bitwise Asset Management for an exclusive look at crypto trends you and your clients. Ric Edelman is the nation's most acclaimed financial advisor, the #1 New York Times bestselling author of 11 books on personal finance. I would like to have an Edelman Financial Engines advisor contact me following the webinar. Ric Edelman, Co-Founder Edelman Financial Engines. - SESSION 3 -. Rose, serial entrepreneur, angel investor and Associate Founder of Singularity University, and Ric Edelman, three times ranked the #1 independent financial. Every weekend, Ric gives you the information you need about the five personal finance topics that matter most today: longevity, retirement security, exponential. In this 1-hour webinar, financial luminary Ric Edelman and well-known hedge fund manager, Anthony Scaramucci, founder of SkyBridge Capital, will reveal: How. M posts. Discover videos related to Edelman Spi Webinar Conference on TikTok. ric Links from today's show: 9/10 Webinar – Bitcoin, Ethereum, or Both? How to Make an Informed Crypto Allocation Decision: prof-expert-orel.ru Join Ric Edelman every weekday for The Truth About Your Future podcast · The Truth About Your Future with Ric Edelman Podcast · Featuring Ric · Webinar Replays. Free, live webinar TODAY at 3pm ET! I'll be joined by Matt Hougan of Bitwise Asset Management for an exclusive look at crypto trends you and your clients. Ric Edelman is the nation's most acclaimed financial advisor, the #1 New York Times bestselling author of 11 books on personal finance.

Ric Edelman. Financial Planning in the Age of Longevity. Anyone alive in Webinar Replays · View all · CE-Eligible Self-Study. Knowledge Center. Edelman Financial Engines offers investing and financial planning services, wealth management, retirement planning, and more. Edelman Financial Engines: 'Magic' Assets Don't Exist. Aug 16, The Rich [WEBINAR] Inauguration Outlook: Preparing for Uncertainty. Presidential. The-Source-Webinar. The Source Webinar. Get insights from industry Ric Edelman and DailyPay are part of the Funding Our Future Coalition to. Tomorrow! Get the info you need to help you decide between #bitcoin & #Ethereum in client portfolios - free webinar 9/10 at 1pm ET! "This made me $15k my first launch". Sean McCormick, Theresa O'Leary, Ric and Halisi, and Tennile Cooper Aaron Morin and Mychal Edelman. The 1:Many. rich walkthrough of flavor trends in the growing organic sector. Global Communications leader Edelman has published its respected annual Trust Barometer for. Last chance – free webinar TODAY at 12pm ET! Join me for crucial info on the new spot Ethereum ETFs. Learn how they compare to bitcoin ETFs. In this one-hour webinar, legendary financial adviser Ric Edelman joins ETF guru and noted crypto expert Matt Hougan of Bitwise Asset Management to examine. Listen to Ric Edelman's THE TRUTH ABOUT YOUR FUTURE with Ric Edelman podcast with Ric Edelman on Apple Podcasts (9/11 Webinar – Register Now for Free!): https. Webinar – Replay | August 8, Are You Ready for a Bitcoin ETF? In this webinar replay, Bitwise CIO Matt Hougan joins Ric Edelman to explain what every. I'm speaking at Webinar: How Crypto is Really Going to Change the World - 12 Use Cases. Would you like to attend? 2 likes, 0 comments - ric_edelman on May 29, "Webinar tomorrow at 12pm ET: The new spot ETH ETFs begin trading soon! Come learn if you should use them. FY21 Empowering Women in Sports: Elevating Marginalized Voices Webinar This event is hosted by the Ric Edelman College of Communication & Creative Arts. Gabriel Edelman, Gary Casagrande, Gautam Moorjani, Gayle Coluccio, Geff Marczyk Rich Prior; Richard Ernesti; Richard Horowitz; Richard Weil; Riley. Have you registered for my live webinar tomorrow? 1 CE credit and get your questions about the new ETH ETFs answered live by me! Are the rich really becoming richer and the poor getting poorer? What is the Larry Zicklin (BBA, '57, left) discusses these questions with Marc Edelman. As they delved into the rich tapestry of Latina narratives, it is crucial to recognize that closing the gender pay gap is an integral aspect of fostering a more. Ric Edelman. @RicEdelman. K subscribers•1K Through DACFP, Ric regularly hosts educational, live webinars for advisors and other financial pros. Edelman Financial Services ($B+). To request the password for the replay David DeVoe.

What Does Line Of Credit Mean

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

A line of credit gives you ongoing access to funds that you can use and re-use as needed. You're charged interest only on the amount you use. A credit line is the amount of money that can be charged to a credit card account. The size of a credit line, and how much of it has been borrowed, have a. A credit line is a flexible loan that allows you to borrow as needed up to a certain limit. Just like a credit card, you don't need to take the whole amount. What does it mean to use my home as collateral? You use your home as collateral when you borrow money and “secure” the financing with the value of your home. Business lines of credit: They are meant for business expenditures that you will repay within months or a few years. A business line of credit is better in. No collateral needed. Most personal lines of credit are “unsecured,” meaning you don't need to pledge an asset as payment if you can't repay what you tap. A line of credit is a type of credit account that works much like a credit card does. It allows a borrower to withdraw money and repay it over and over again. You can borrow as little or as much as you need, up to your approved credit line and you pay interest only on the amount that you borrow. You can take advantage. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses. A line of credit gives you ongoing access to funds that you can use and re-use as needed. You're charged interest only on the amount you use. A credit line is the amount of money that can be charged to a credit card account. The size of a credit line, and how much of it has been borrowed, have a. A credit line is a flexible loan that allows you to borrow as needed up to a certain limit. Just like a credit card, you don't need to take the whole amount. What does it mean to use my home as collateral? You use your home as collateral when you borrow money and “secure” the financing with the value of your home. Business lines of credit: They are meant for business expenditures that you will repay within months or a few years. A business line of credit is better in. No collateral needed. Most personal lines of credit are “unsecured,” meaning you don't need to pledge an asset as payment if you can't repay what you tap. A line of credit is a type of credit account that works much like a credit card does. It allows a borrower to withdraw money and repay it over and over again. You can borrow as little or as much as you need, up to your approved credit line and you pay interest only on the amount that you borrow. You can take advantage. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses.

Before there were faster, more efficient ways of processing payments with your credit card, you would be able to take out what's called a line of credit. A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the. How does a line of credit work? If your checking account doesn't have the funds to cover a transaction, it will automatically pull the necessary funds from. A bank line or a line of credit (LOC) is a kind of There is a draw term, which means that funds can only be taken out during a set period of time. A line of credit is a pre-approved loan that allows you to get money when you need it and not all at once. Line of credit meaning. A line of credit, often abbreviated as LOC, is a flexible borrowing arrangement between a financial institution and an individual or. A business line of credit is a flexible loan for businesses of all sizes. It allows businesses to borrow money up to a certain amount when needed. A loan and line of credit are both ways for people to borrow money and pay it back over time. But there are differences in how you receive funds and how you. With a line of credit, you may spend up to the maximum amount you are allowed to borrow any time you need it. The money you borrow does not go into your bank. While traditional personal loans have a fixed term, a line of credit lets you access extra money whenever you want (up to your credit limit). This means you. An unsecured line of credit means you aren't using an asset as collateral — but typically comes with higher interest rates to insure against the risk of default. A line of credit (also known as a bank operating loan) is a short-term, flexible loan that a business can use to borrow up to a pre-set amount of money. Both allow you to borrow against the appraised value of your home, providing you with cash when you need it. Here's what the terms mean and the differences. With a personal line of credit from Regions, you can borrow money or withdraw cash as needed. Find out more to choose the best line of credit for you. How much do you pay in interest? Personal loans carry fixed interest rates while personal lines of credit usually have variable rates over time — it'll depend. On a personal line of credit, you pay interest on what you borrow, and interest accrues immediately. The APR is usually variable, which means it can fluctuate. Home equity line of credits are a type of second mortgage, meaning you can get a HELOC even if you still have a first (or primary) mortgage on your house, and. An Unsecured Line of Credit is a variable rate credit product that provides access to funds when you need them. Unlike a loan, a business line of credit allows you to use funds only when you need them, and you are only required to make periodic payments on the amount that. The two work similarly. You use the money you need when you need it and only pay interest on what you borrow. Usually, they are revolving, meaning as you pay.

1 2 3 4